Legislation to spur creativity and innovation here in Michigan passes the House

LANSING, Mich., Nov. 1, 2023 — The Michigan House of Representatives passed House Bills 5099, 5100, 5101, 5102 and 5187 yesterday. This economic development package would create and administer a state-level tax credit to offset the costs of research and development (R&D), encouraging businesses of all sizes to explore new technologies and create jobs for hardworking Michiganders.

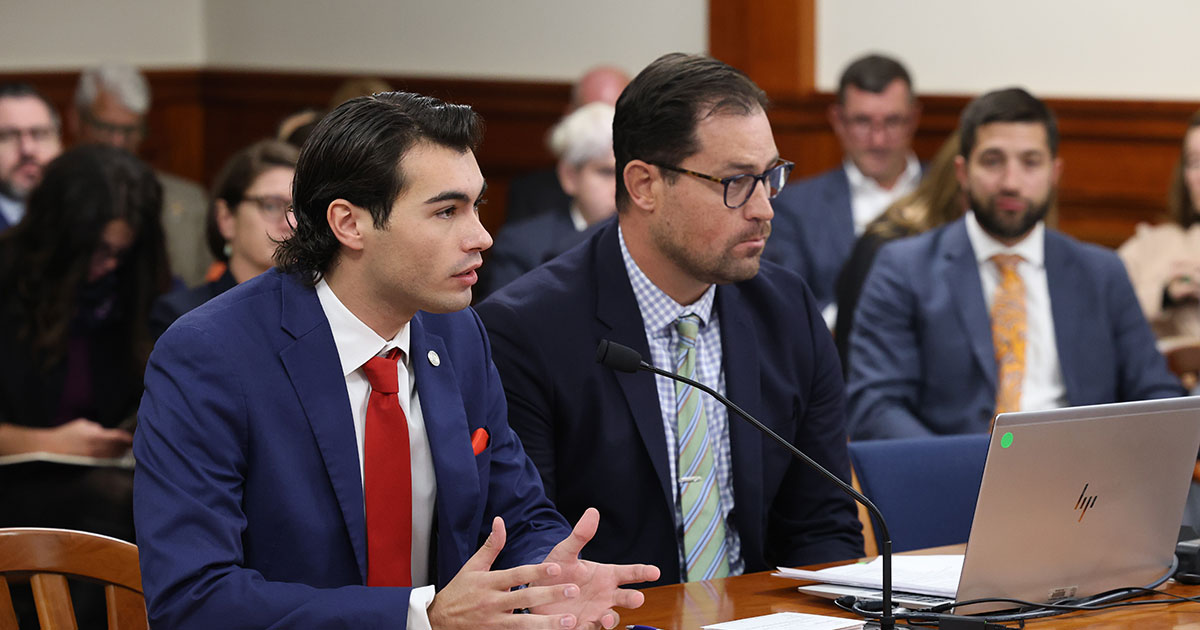

“I am thankful for my colleagues on both sides of the aisle for helping us craft a policy that is an investment in our future,” said state Rep. Jasper Martus (D-Flushing), sponsor of HB 5100.

The proposed R&D tax credits outlined in the bill package, patterned after federal credits, would support projects on the cutting edge of innovation with a high return on investment for a positive economic impact. The bill package creates a refundable tax credit, which makes it usable for companies with no tax liability, for businesses that conduct R&D on promising products and processes. The legislation also recognizes the important role of our research universities.

“The benefits to our economy will be substantial, but even more important is the chance for lifesaving medicines and new forms of technology to happen because of this legislation,” Martus continued. “The credit would be structured in a way so both large and small businesses would benefit, and there are extra incentives for collaboration with our universities. All of this makes innovation and advancements more likely that will benefit the lives of people across the globe. It will also happen here in Michigan, which creates jobs for our friends and neighbors.”

###