Hi Neighbor,

Welcome to the latest edition of my e-newsletter! From wrapping up March is Reading Month to getting started on spring cleaning, I wish you and your loved ones a refreshing start to the season. Read on to learn more about my upcoming office hours, reflections on March is Reading Month and resources to help you tackle your taxes.

I am honored to continue representing and advocating for our community in Lansing. Please feel free to go to my website at RepFitzgerald.com to stay up-to-date on our work and to email at JohnFitzgerald@house.mi.gov or call at (517) 373-0835 to voice your opinion, ask a question or express a concern. My dedicated staff is here to support you and answer any questions you may have.

Respectfully,

John Fitzgerald

Minority Floor Leader

State Representative

House District 83

In this edition:

- Office Hours

- Community Resources

- Legislative Update

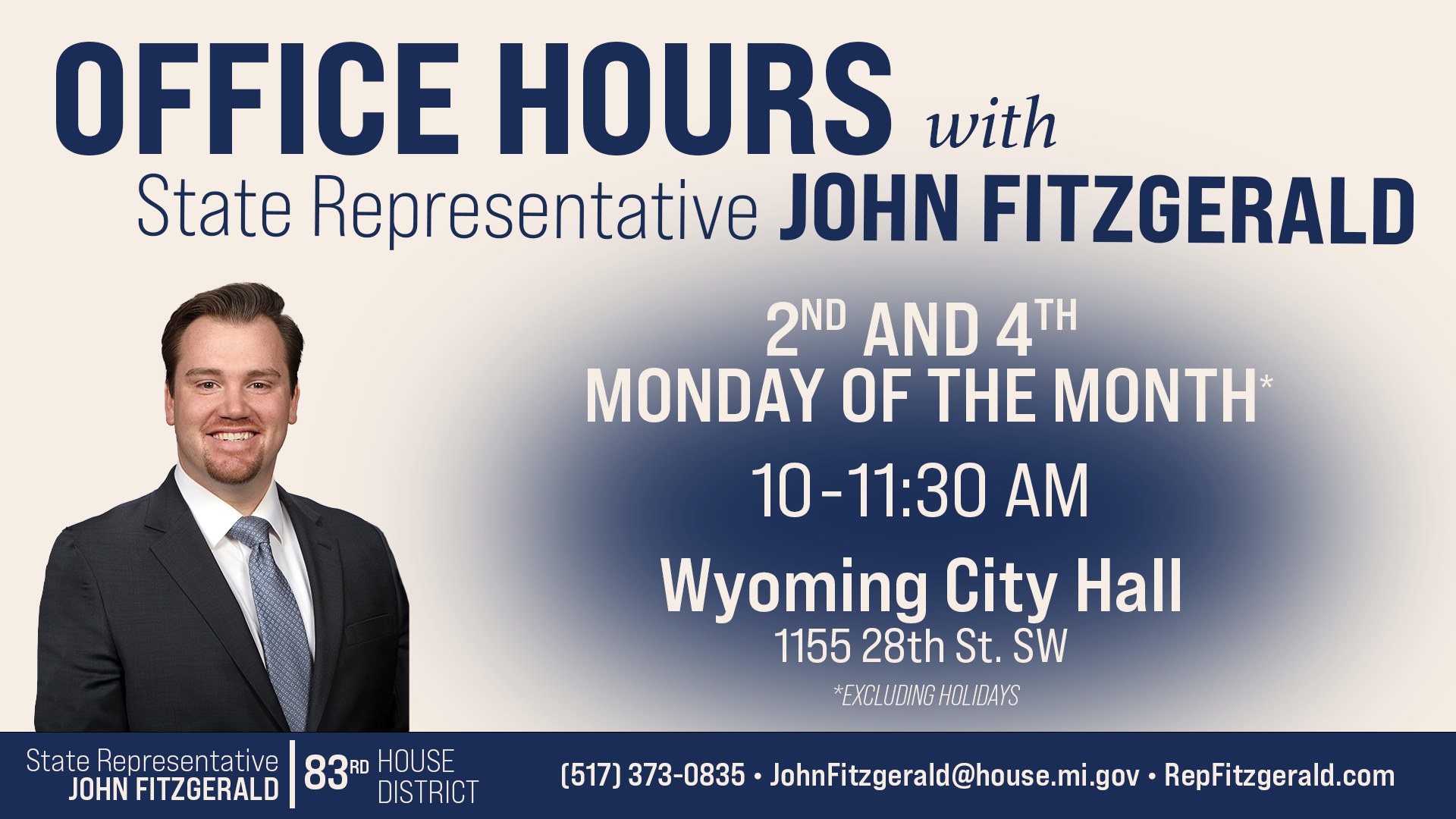

Office Hours:

I hold office hours twice a month to hear your thoughts, questions and concerns. This is a great opportunity to meet with me in person to discuss the issues that affect our community. I look forward to meeting with you!

When: Every 2nd and 4th Monday of the Month from 10-11:30 a.m.

Where: Wyoming City Hall, 115 28th St. SW

Community Resources:

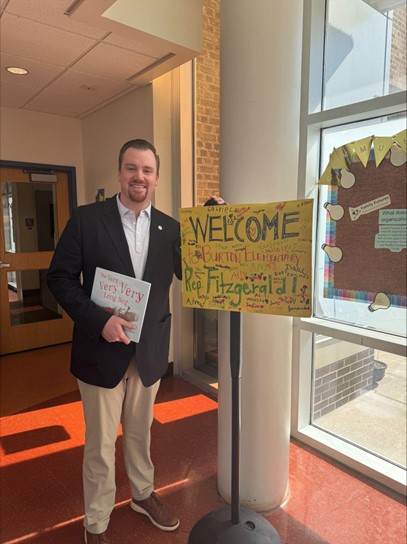

Wrapping Up March is Reading Month!

I hope you and your family took advantage of the amazing libraries in our community this month to explore the benefits reading has for people of all ages. The power of reading can be life-changing, and setting up our young readers for success is crucial for their lifelong success. This month, I had the privilege of visiting and reading to classes at elementary schools and libraries in our community, including at:

- Godfrey Elementary

- Burton Elementary

- Grandview Elementary

- Cesar Chavez Elementary

- Oriole Park Elementary

- Buchanan Elementary

- Parkview Elementary

- Vanguard Charter Academy

- Kent District Library, Wyoming Branch

I want to extend a huge thank you to the teachers and staff at these schools for their warm welcome and dedication to supporting our kids on their reading and literacy journeys. We certainly have very impressive and passionate young readers in our community. As March comes to a close, I encourage everyone to keep finding time in your daily routine to curl up with a good book and find power in reading.

Individual Income Tax Returns Due Next Month

Thank you to everyone who turned out to my Community Conversation with Volunteer Income Tax Assistance program and United Way earlier this week to discuss the resources available to you to help tackle your taxes. With state and federal taxes due on April 15, below are some resources that provide free tax assistance:

- Disabled, low-income or taxpayers who are 60 years of age or older may be eligible for free tax help from IRS-certified preparers.

- The Volunteer Income Tax Assistance program offers free tax help from IRS-certified volunteers. VITA services are available to people who generally earn $58,000 per year or less, people with disabilities and people who speak limited English.

- The AARP Tax-Aide program offers free tax help to people over 50 or people with low to moderate income. AARP membership is not required to receive services.

- Those making $73,000 or less may be able to use the IRS Free File site to prepare federal and possibly state tax returns.

- Those making more than $73,000 can prepare and file taxes for free using IRS Free Fillable Forms. This allows taxpayers to prepare and file taxes online, but still requires them to follow IRS instructions and fill out the forms.

Additional free tax services can be found at michiganfreetaxhelp.org, irs.treasury.gov/freetaxprep or by dialing 2-1-1.

Electronic filing and direct deposit is fast, convenient and safe. Learn more at Michigan E-File Information MIFastfile.org

Please also be aware of the following tax credit and benefit programs that may be of use to you:

-

- Home Heating Credit: This is a tax benefit for qualified Michigan homeowners and renters with low to moderate income that can help pay for some of their heating expenses. Those who do not qualify for this credit may alternatively qualify for assistance through the Low Income Home Energy Assistance Program.

- Retirement and Pension Benefits Subtraction: This is a reduction of all eligible retirement income from your Michigan taxable income. Please note that retirement income is reported on Form 1099-R for federal tax purposes and includes defined benefit pensions, IRA distributions and most payments from defined contribution plans.

For information about individual income tax returns and refunds, visit the Treasury eServices website.

Submit a Tribute to Celebrate a Community Member

Do you know anyone celebrating a milestone birthday or retirement? What about an anniversary of a homegrown business or a sports achievement? A great way to celebrate the immense work of people in our community is to request a tribute certificate from my office.

Click here to suggest a tribute

I look forward to recognizing the great achievements of our community!

Legislative Update:

House Committees are in Full Swing!

I am excited to share that the House Committees I serve on have all commenced including the House Committees on Insurance, House Fiscal Governing and Government Operations. As Minority Vice Chair of the Committee on Government Operations, I look forward to continuing to hear testimony on and shape legislation to improve transparency and efficiency in government operations across the state.

Testifying in Health Policy Committee

I testified in the Health Policy Committee last week in support of House Bill 4102, legislation I sponsored that would increase health care access to physical therapy services in our state. My bill would make Michigan a member of the Physical Therapy Compact Commission, a governmental organization made up of that improves access to physical therapy services by reducing regulatory barriers to interstate mobility and cross-state practice, all while maintaining the high standards of qualifications for physical therapy providers.

This legislation will attract and retain more physical therapists to Michigan, meaning more communities will have access to this essential health service. I look forward to continuing our work on this legislation to help our state join the 32 other states with Physical Therapy Licensure Compacts, and increase health care access for Michiganders.