Legislation fills gap for those who rent or lease their home

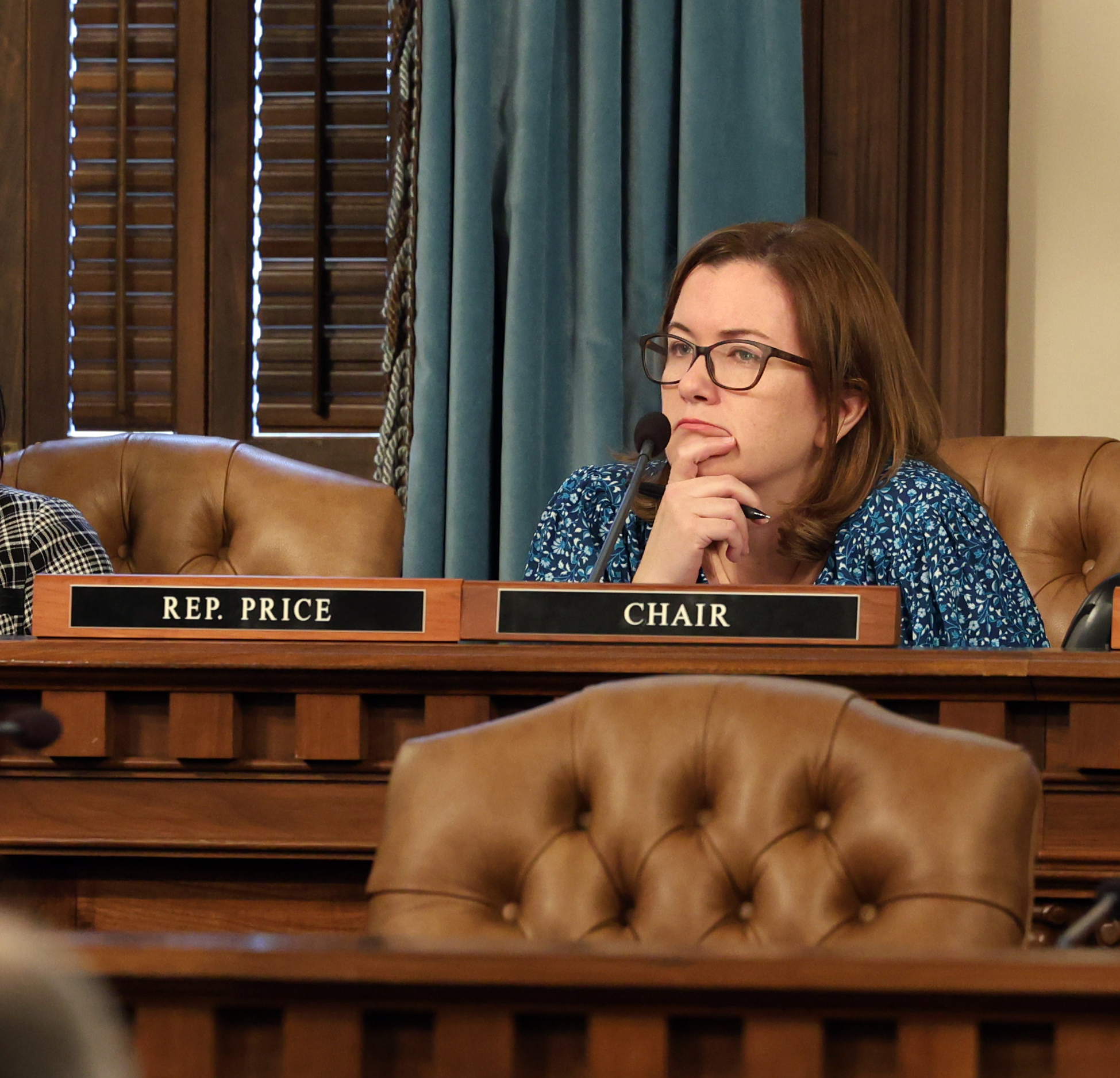

LANSING, Mich., June 7, 2023 — State Rep. Natalie Price (D-Berkley) introduced legislation to give more disabled veterans access to property tax relief. House Bill 4724 would allow veterans rated as 100% disabled, or a surviving spouse if the veteran is deceased, to claim an income credit against their full property taxes if they rent or lease their homestead. Currently, only veterans and spouses who own their home can make this claim.

“The needs of our disabled veterans don’t change whether they own or rent their home. Whatever their living situation, all 100% disabled veterans deserve this relief,” Price said. “This was an oversight in the original legislation, and I’m proud to introduce a bill to fix it.”

On Veterans Day of 2013, Public Act 161 was signed into law after it passed both chambers of the Legislature unanimously. It allowed veterans who the federal Department of Veterans Affairs rated as 100% disabled to claim a full exemption of their annual property taxes. HB 4724 will use the same formula that renters currently use to calculate their percentage of property tax for the purposes of claiming the Homestead Property Tax Credit to determine the full amount of their income tax exemption.

“The way this legislation is crafted means that the beneficiaries of property taxes — local governments and schools — will not lose any revenue with the expansion of this truly deserved tax relief,” Price said. “This is a win-win for the veterans who were injured in the course of their service and the communities they call home. I look forward to working hard to see this bill signed into law.”