Dear Neighbor,

After so much snow in February, I’m sure I’m not alone in looking forward to the sunshine and upcoming spring. As we move along through Michigan’s budget season, I’ve been monitoring how proposed federal budget cuts will affect our state. Below are some updates from the past few weeks.

New Committees Met for the First Time

In this new legislative session, House committees have been reassigned. I have the privilege of being minority vice chair of the Committee on Oversight, as well as serving as a member of the Committee on Transportation and Infrastructure. In February, these committees met for the first time. I look forward to working with my colleagues in these committees!

Standing Up for Rights and Freedoms by Defending Marriage Equality

I’m proud to have stood with my colleagues to reaffirm our dedication to protecting marriage equality in Michigan. Unfortunately, another representative, along with six co-sponsors, introduced House Resolution 28, condemning the U.S. Supreme Court decision Obergefell v Hodges that legalized same-sex marriage.

Every person’s right to marriage equality was affirmed by this Supreme Court decision nearly 10 years ago. This is not an issue state governments should concern themselves with when they can better spend their time addressing real issues that affect our communities. We need to be moving forward and working together as a Legislature to solve issues affecting Michiganders, not revisiting a nonissue that, if overturned, would create chaos and heartbreak for millions of families across the state. It is not up to elected officials to tell people who they can and cannot love, and I firmly stand against any attempts to overturn marriage equality.

Supporting Ban on NDAs and Closing the Lawmaker-to-Lobbyist Revolving Door

I was proud to help pass bipartisan legislation that will provide more transparency and accountability in Michigan. House Bills 4052 and 4053 would ban legislators and their staffers from signing nondisclosure agreements (NDAs). House Bills 4062, 4063 and 4064 would ban executive officeholders and legislators, including the governor and heads of state departments, from engaging in lobbying for the first two years after leaving office. Further, these bills would ban lawmakers and officials who are currently serving from receiving additional compensation beyond their legislative salaries for lobbying activities. These commonsense and ethical bills will help close the lawmaker-to-lobbyist revolving door in Lansing and make our lawmakers more representative of their constituents.

Federal Cuts to Veteran Affairs Medical Centers

I stand firmly opposed to the recent firings at the John D. Dingell Department of Veterans Affairs Medical Center in Detroit and the Ann Arbor Veterans Affairs Healthcare System. It is appalling that the White House and our federal government would cut resources that help our veterans. We have a responsibility as elected officials to make sure our veterans and those who care for them are supported — anything less is unacceptable. I express my immense gratitude for our veterans and their service to our country, as well as the hard work of the employees who care for them.

Massive Cuts to Our State Budget and Our Schools

In early March, the Republican House Speaker surprised us with a rushed vote on the Republican-led House budget proposal for fiscal year 2025-2026. We were given virtually no time to review these bills, as we first received the bills 30 minutes before we were expected to vote on them. Previously, the Speaker promised no bills would be voted on unless they were introduced 24 hours before.

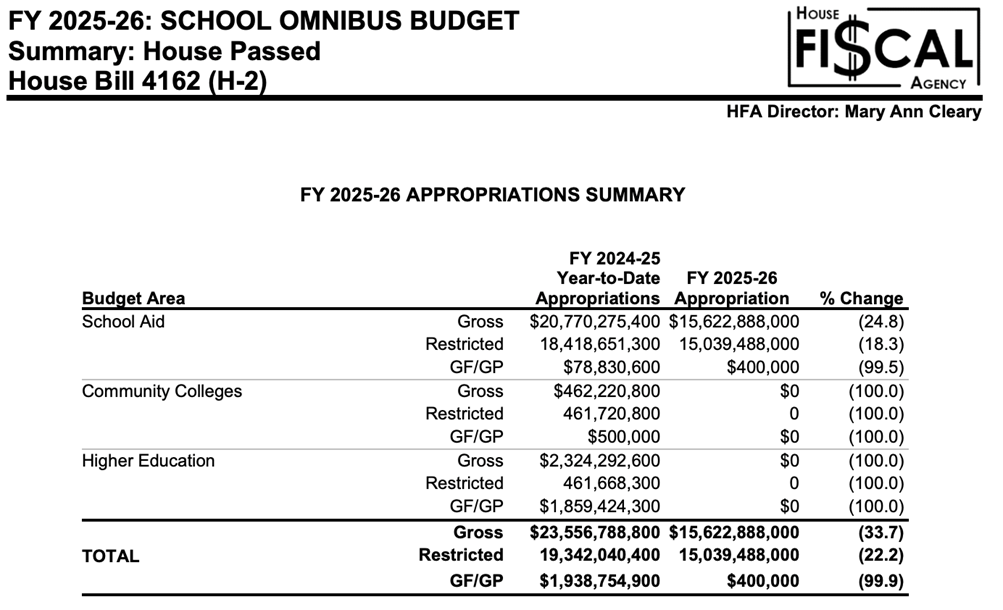

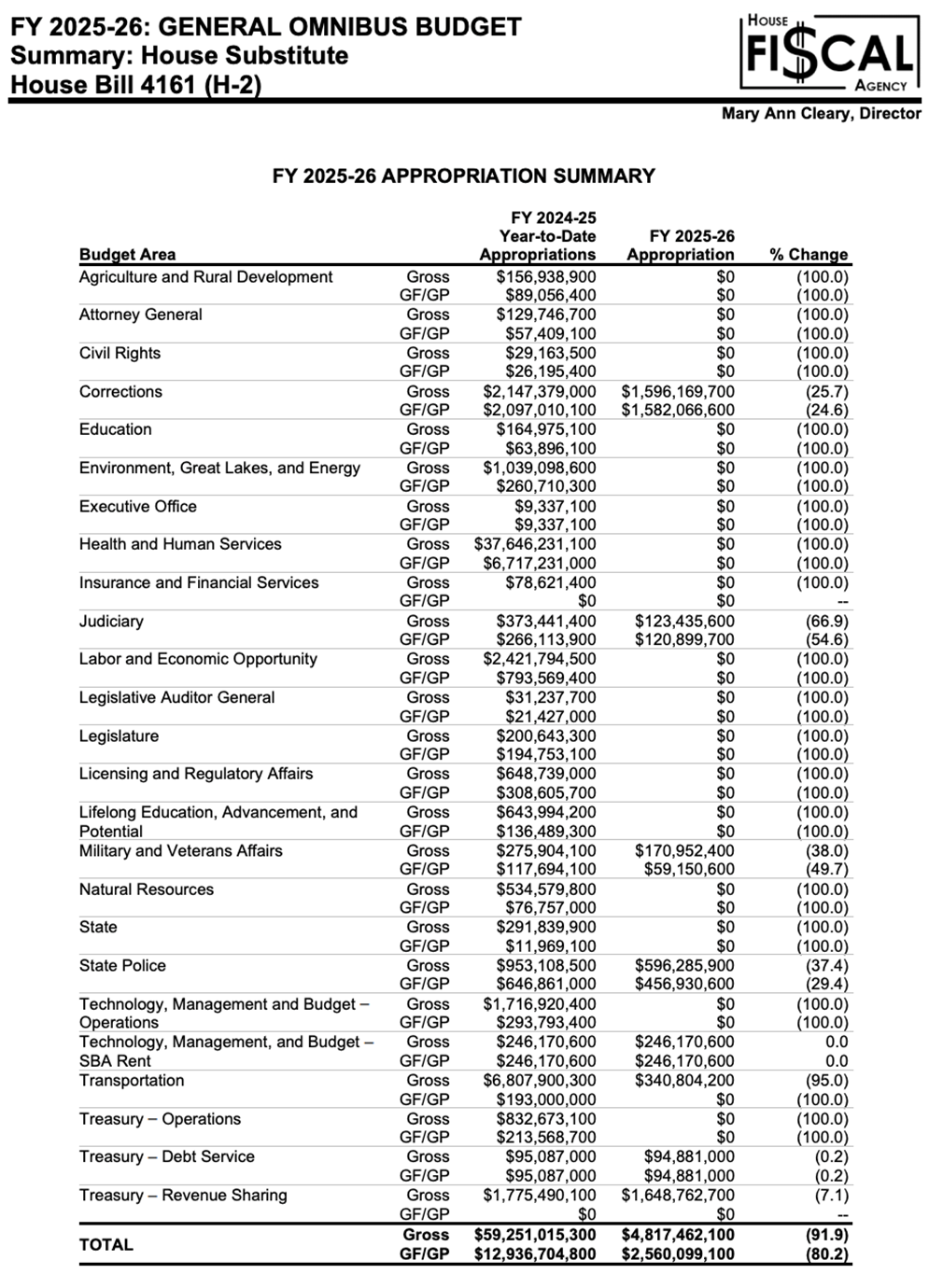

These two budget bills, House Bills 4161 and 4162, were voted on within minutes, with no committee hearings and little time for debate or discussion. Only two Democratic representatives were allowed to speak on the floor in opposition, with one Representative having her mic cut off while in the middle of speaking. I voted no on these harmful bills, but Republicans passed them with full support.

This Republican-led budget plan that they passed through the House cuts 92% of state investments for the non-school aid budget, and 25% (over $5 billion) of the K-12 budget. Republicans voted for these cuts to education in front of school children visiting our Capitol on a field trip.

This budget will harm Michiganders through cuts to numerous budget areas, including:

■ Removes 100% of Funding from the Michigan Department of Health and Human Services (MDHHS)

- The Republican-led budget removes health care access from 2.7 million Michiganders, which means one in four Michiganders would lose health care

■ Removes 100% of Funding from the Department of State (MDOS)

- The Republican-led budget makes our elections less secure. The Secretary of State’s office oversees elections, driver’s licenses and vehicle registration, business services, notary and official records. Without funding, this office would be unable to administer these services.

■ Removes 100% of Funding from the Department of Agriculture and Rural Development (MDARD)

- The Republican-led budget harms our rural communities. MDARD oversees food safety, public health, farming and agribusiness, economic development in rural areas, environmental protection and animal health and welfare. Without this department we will see our state’s rural and farming economies suffer. Further, this will hinder Michigan’s response to the worsening avian flu outbreak.

■ Removes 100% of Funding from the Department of Environment, Great Lakes and Energy (EGLE)

- The Republican-led budget makes it easier to pollute in Michigan. EGLE oversees and protects our state’s natural resources and regulations. Cuts to EGLE will allow big business to continue to pollute our environment without any enforcement mechanism from the state.

■ Removes 100% of Funding from the Department of Labor and Economic Development (LEO)

- The Republican-led budget makes Michigan less safe for workers and less attractive to businesses. LEO administers unemployment assistance in MI. They also oversee workplace safety, labor protections and economic incentives in the state. LEO helps Michigan remain competitive against other states.

■ Removes 100% of Funding from the Office of Attorney General

- AG Nessel has been proactive and effective in challenging the current presidential administration at the state level. Without funding, this office will not be able to pursue criminals in Michigan and push back against the president.

■ Removes 38% of Funding from the Department of Military and Veterans Affairs

- The Republican-led budget harms our military veterans and their families. The Department of Military and Veterans Affairs provides mental health support, job training, housing assistance, and VA claim assistance to veterans in Michigan. This comes at the same time that the president’s administration is planning to fire 80,000 VA workers across the country.

■ Removes 37% of Funding to the State Police

- The Republican-led budget removes funding for our state police. Michigan State Police provides statewide law enforcement, especially in rural areas without strong local police departments. They also provide specialized units, such as the Drug Enforcement Section, which would no longer be able to combat organized crime, human trafficking, or drug smuggling as effectively.

■ Removes 25% of Funding from the K-12 Budget

- The Republican-led budget removes $5 billion in funding to classrooms and $1 billion to at-risk students. It also eliminates the free breakfast and lunch program, removes funding for special education, technical education, transportation, community college and more. This comes on the heels of the presidential administration preparing to eliminate the Federal Department of Education.

Put simply, this is not a real attempt to govern responsibly — it’s a reckless attempt to subvert the budget process and remove critical investments that support our communities. This isn’t just a government shutdown plan, it’s a government obliteration plan. What it means for Michiganders is that your vital services, good-paying jobs and opportunities would be eliminated. I voted against these bills because they disinvest in Michigan and our people.

Below is the session board displaying how representatives voted, as well as the nonpartisan House Fiscal Agency analysis of House Bills 4161 and 4162. The bills will now make their way to the Senate.

Minimum Wage and Earned Sick Time Act Changes

After hearing from many constituents in our district about the changes to minimum wage, sick time and the tipped wage resulting from the Michigan Supreme Court’s ruling last August, I supported a bipartisan bill package that brought workers and small business owners to the table to find a compromise that supported everyone. As introduced, House Bill 4001 did not do enough to protect workers or our small business owners. I offered an amendment to this bill to bring fairness and equity to our tipped workers by outlining a 10-year phase-in plan to increase tipped wages, ultimately ensuring that all workers in Michigan receive the full minimum wage while giving small businesses the time needed to adapt to these changes. My amendment proposed a gradual increase in tipped wages that would rise incrementally until reaching parity with the full minimum wage by 2036. My amendment was not adopted, and therefore I voted no on HB 4001. Ultimately the Senate offered their own bill, Senate Bill 8 (Public Act 1’25), and this bill, along with HB 4002 (PA 2’25), found a solution for both workers and small business owners. Below are some of the key changes resulting from the passage of these bills.

Key changes to Michigan’s minimum wage:

Regular minimum wage: PA 1’25 gradually increases the minimum wage to $12.48 starting February 21, 2025, reaching $15 starting Jan. 1, 2027, and adjusts for inflation after that. This bill raises the minimum wage quicker than the original Supreme Court ruling.

Tipping Minimum Wage: PA 1’25 gradually increases the minimum cash wage for tipped employees from 38% of the full minimum wage to 50% of the regular minimum wage by 2031. The tipped minimum wage is $4.74 for the rest of 2025.

For more information please visit LEO’s factsheet on the minimum wage changes.

Key changes to Michigan’s Earned Sick Time Act, PA 2, 02 2025 (HB 4002 (S-3):

Accrual Method: Employees accrue 1 hour of paid sick time for every 30 hours worked, and unused paid sick time rolls over up to 72 hours, or 40 hours for a small business. Employers may limit the use of earned sick time to 72 hours, or 40 hours for a small business, in the 12-month period. Small business is defined as an employer having 10 or fewer employees.

New Hire Waiting Period: If using the accrual method, employers may have a policy for new employees hired on or after February 21, 2025, requiring these employees to wait up to 120 days before using accrued sick time. Employees accrue earned sick time during this waiting period. If frontloading, hours are available for immediate use.

Small Business Compliance: Small businesses have until October 1, 2025, to comply with ESTA requirements.

Frontloading Paid Sick Time: As an alternative to the accrual method, employers can choose to frontload at least 72 hours of paid sick time for immediate use each year, or 40 hours for a small business, which eliminates the requirement for carryover or accrual tracking for full-time employees.

Frontloading Part-time Employees: As an alternative to the accrual method, employers may frontload paid sick time for part-time employees as well, with a prorated amount, subject to specific notice and true-up requirements.

PTO Policy: Employers can use a combined paid time off (PTO) policy to meet ESTA requirements, as long as the total paid leave meets or exceeds the necessary amounts and may be used for the same purposes.

Hourly Rate: For ESTA purposes, an employee’s hourly rate is their normal hourly wage or base rate and excludes overtime, holiday pay, bonuses, commissions, tips, etc.

Enforcement: The Department of Labor and Economic Opportunity (LEO) is responsible for enforcing ESTA.

Sick Time Increments: Employers may choose to use either one-hour increments or the smallest increment used for tracking sick time.

More information can be found on the Michigan Labor and Economic Opportunity’s (LEO) Wage and Hour Division website. There is an FAQ available, but if you don’t find answers to your questions there, you can reach out directly to LEO’s Wage and Hour Division by phone at 517-284-780 or via email at WHinfo@michigan.gov.

For more information please visit LEO’s Frequently Asked Questions on the ESTA.

And for posting requirements.

Tax Information

Tax law hasn’t changed significantly for the 2025 season, but I’d like to share some resources that may help you on your taxes this season. General information about taxes can be found on Michigan’s Department of Treasury website.

In addition to the Earned Income Tax Credit (EITC) from the federal government, Michigan now offers an expanded state EITC credit. In 2023, my colleagues and I successfully worked to quintuple Michigan’s EITC match of the federal EITC from 6% to 30%, so for every dollar in EITC credit that residents receive from their federal tax return, they will receive an additional 30% from the State of Michigan when filing their Michigan return. This was the largest increase to Michigan’s EITC in state history. This was first implemented in tax season 2024 and is still in effect. This expansion puts more money in the pockets of working families and helps fight poverty by providing a tax credit to working people with low to moderate income. Qualifying individuals receive a cash payment (via direct deposit or paper check) after filing their taxes.

Through the Child Tax Credit, families can receive a tax credit of up to $2,000 for each child under the age of 17. You may qualify for the Child Tax Credit if you meet all of these criteria:

- You are a parent, guardian or caregiver with dependent children under 17. Children who turned 17 on or before Dec. 31, 2024, are not eligible.

- The child has lived with you for at least six months in 2024.

- You provide the majority of the financial support for the child. You do not have to be the child’s biological parent or have formal custody to qualify.

- The child has a Social Security Number. If you do not have a Social Security number, you can still file your taxes with an Individual Tax Identification Number (ITIN). However, the child must have a Social Security Number to receive the Child Tax Credit.

- You have a minimum yearly income of $2500 earned from working. The COVID-era exceptions that waived this requirement have not been renewed.

Additionally, while I’m legally unable to use this enews to link to websites with “donate” buttons, I’d like to pass along that United Way for Southeastern Michigan provides tax assistance through their “Get the Tax Facts” program. This includes an easy scheduling tool where residents can schedule online for the IRS’s Volunteer Income Tax Assistance (VITA) appointments, as well as view FAQs about the benefits of filing, the filing process, the key tax credits available to low-income individuals and more. Please see the flyer above for general search times to find these United Way resources. You can also find VITA providers in your area by clicking here.

Sincerely,

State Representative Reggie Miller

Michigan’s 31st District

Office Phone: (517) 373-0159

Email: ReggieMiller@house.mi.gov